Retirement Planning

When should I start saving for retirement?

While having a 401(k) or IRA is a great start, a solid financial plan takes a closer look at the income you have coming in, and the amount you'll need to supplement. The earlier you start planning, the longer you have to build up your savings and put your plan into action. But even if you plan on retiring in the next year or two, there's time to get prepared.

Time waits for no one put time on your side

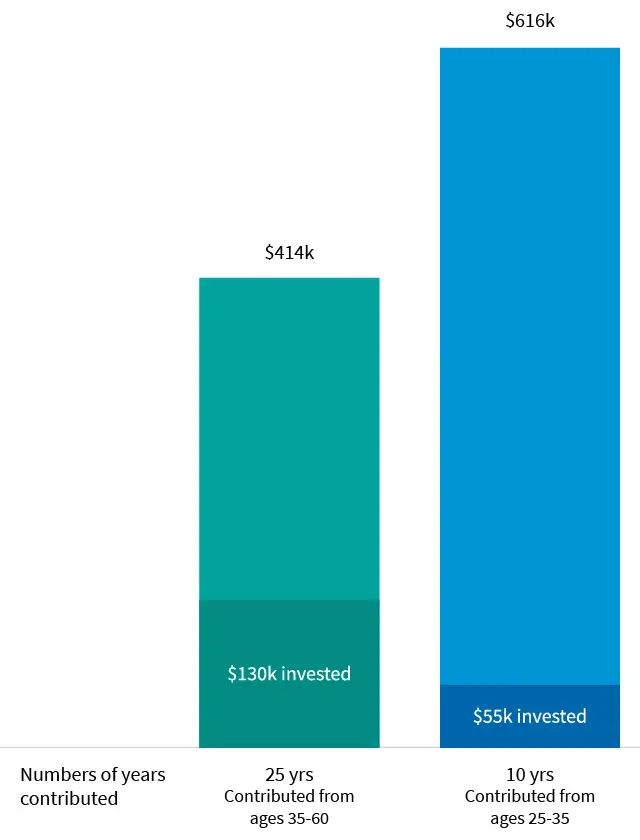

We often hear about the importance of starting early to save for retirement, but it's hard to visualize the difference that starting early can make. Regardless of the rate of return (as long as it's greater than zero) a person who only saves from ages 25–35, will always have considerably more money by age 60, than the person who saved from ages 35–60. Thanks to compounding interest, you can end up with more money, after saving for fewer years, as long as you start earlier.

For example: Someone contributing $5,000 a year from ages 25 to 35, will have an account balance of $615,580 at age 60, given an annual return of 8%. Whereas someone contributing $5,000 a year from ages 35 to 60, will have an account balance of $413,754 at age 60, given the same annual return of 8%. At age 60, the person who contributed earlier, will end up with a balance 42.5% higher, despite contributing for just 10 years, versus the person contributing later, for 25 years.

What are some sources for retirement?

Beyond traditional investments, here are some more places where you can find money for retirement:

- Put money away now, for a guaranteed income later with annuities.

- Aside from keeping your loved ones' financial future bright, you can use living benefits from your universal life insurance policy after you stop working.2 More about Life Insurance

- IRAs and your employer's 401(k) plan are good ways to save for retirement today. Learn more about IRAs and 401(k)s.